Tenants and landlords are in a bit of a pressure cooker right now – increasing mortgage rates, a heated rental market, and higher prices for daily essentials including utilities, are all contributors. Unsurprisingly, raising the rent is a hot and sensitive topic between landlords and tenants. Read on to find out what landlords need to know.

Raising the rent is invariably a sore point between landlords and tenants. Let’s be honest, no-one likes the idea of paying more for anything, but price increases are often inevitable – rents respond to what’s happening in the wider social and economic environment. Landlords set rents based on several factors, including market conditions and their own financial considerations. When these factors change, landlords may look to adjust the rent in response.

In the current economic climate – high inflation, cost of living pressures, rising interest rates, mounting rental unaffordability, lack of rental stock – a rent rise may be particularly bad news for tenants. Knowing there may be resistance from tenants, it pays to make sure landlords know the rules about rental increases.

Why rent increases concern your insurer

Now you may be wondering what business it is of a landlord insurance provider if you raise the rent. Well, it becomes our business because there are insurance matters to consider too. Such as? Glad you asked.

Given the contentious nature of rent increases, there is a possibility that negotiations may not go well, and relations may sour. If this happens, there’s a risk that a tenant’s actions may affect the rental. For example, the tenant may stop paying their rent or even damage the property – and that can lead to insurance claims.

Speaking of claims… You need to make sure you’ve updated your paperwork. Once you’ve set a new rent amount, you need to make sure the lease agreement and rent ledger are updated. If you need to make a claim for rental losses, you’ll need to provide these documents as supporting evidence. As the payout is likely to be based on the documented rent figure, it pays to make sure it’s accurate.

Another matter to consider when raising the rent is whether the amount you are charging is within the insurance policy limits. Landlord insurance policies will set a maximum rent that the insurer is willing to cover, for example for EBM RentCover policies it’s $1,500 per week. If the rent increase will push the weekly rent above the limit, you’ll need to get in touch with your insurance provider to discuss options.

Obviously, acting lawfully is also a must. Each state and territory has a residential tenancy act which sets out the relevant responsibilities and rules, including those relating to raising the rent. If you raise the rent outside of the legislated parameters, you could find yourself at the tribunal or in court. It can also impact your landlord insurance cover. To reduce the risk of your claim being denied on the grounds that you didn’t fulfill your legal obligations, become familiar with, and follow, the rules.

Which brings us to what landlords need to know about rent increases

We’ve provided an overview of the rules around rent increases in each jurisdiction below. This is just a high-level guide, and you should always check the current rules in detail before raising the rent. You can do this by chatting with your property manager, consulting the relevant tenancy authority in your state or territory, or by reading the applicable legislation.

State-by-state or territory rules

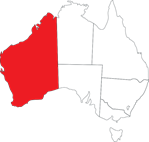

Western Australia

Western Australia

Overview:

- Periodic tenancies: Rent increases can occur at six-monthly intervals (but no sooner) and tenants must be given at least 60 days’ written notice, with details of the amount of the rise and the day it will take effect. The tenant only has to pay the increase if proper notice has been given.

- Fixed-term tenancies: Rent can only be increased if the written agreement specifies how much the rent increase will be or the method of calculating the rent increase is shown (e.g. by a percentage). If the rent can be increased, it can take effect no sooner than six months after the commencement of the tenancy agreement and the date of the last increase. Landlords must give tenants at least 60 days’ notice of the increase.

- New agreement: If an existing tenant’s fixed-term lease ends and they continue to rent the same property on a new fixed-term agreement, or if the lease rolls into a periodic agreement, a rent increase cannot take effect for the first 30 days of the new agreement.

More info:

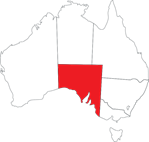

South Australia

South Australia

Overview:

- Landlords must provide tenants with at least 60 days’ written notice of a rent increase.

- There is no limit to how much rent can be increased.

- Generally, rent can be increased after 12 months from the date of the last rent increase or from when the agreement started.

- Fixed-term agreements: Rent can only be increased during the term of the agreement if a condition allowing for a rent increase is included in the agreement. The agreement must state how the increase will be calculated (e.g. based on CPI). At least 60 days’ written notice must be given. The increase cannot take effect until 12 months after the agreement commences or when the rent was last increased.

- Fixed and periodic agreements. Rent can only be increased if at least 60 days’ written notice is given and the increase starts at least 12 months after the agreement began, or the rent was last increased. The specific amount of the increase and the date it will commence must be included as a condition in the agreement, for example, rent will increase to $400 per week from 1 July. Rent can be increased with an offer for a lease extension provided at least 12 months has past since the agreement commenced or the rent was last increased.

More info:

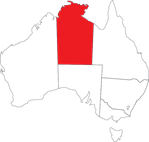

Northern Territory

Northern Territory

Overview:

- Rent can only be increased during a tenancy if the right to do so has been written into the tenancy agreement.

- The agreement must state the amount of the increase or the method of calculation.

- Landlords must give tenants at least 30 days’ written notice of the increase.

- The date on which the rent increase takes effect must be either at least six months after the tenancy started, or six months from the last increase.

- If the original tenancy agreement does not provide for a rent increase and does not specify the amount of the increase or method of calculation, rent can be increased during the tenancy agreement or during any extension of the original term if landlord and tenant agree.

More info:

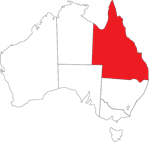

Queensland

Queensland

Overview:

- Periodic agreements: Rent can be increased if the landlord gives the tenant at least two months’ written notice and it has been at least six months since the last rent increase, or since the tenancy started.

- Fixed-term agreements: Rent cannot be increased during a fixed-term unless there are appropriate provisions in the tenancy agreement. The agreement must state the new amount or the method by which it will be calculated. The landlord must give the tenant at least two months’ written notice of the increase and the increase cannot take effect for at least six months after the tenancy commences or since the last increase. The landlord must give the tenant separate written notice of the increase – it does not automatically come into effect because it’s in the agreement. The notice should include the increased amount and the day it takes effect.

- New agreement: The landlord and tenant can agree to a rent increase at the end of a fixed-term agreement by entering into a new agreement. Any increase cannot take effect for at least six months after the last increase. There is no requirement to serve a notice about the increase. If a new fixed-term agreement is not signed, the agreement becomes periodic, and the rent can be increased by giving two months’ notice prior to or upon commencement of the periodic agreement. In this instance, the rent increase can only take effect at least two months after the commencement of the periodic agreement.

More info:

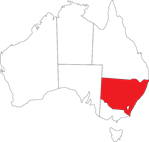

New South Wales

New South Wales

Overview:

- Periodic agreements: Rent can only be increased once in a 12-month period. The landlord must give the tenant at least 60 days’ written notice of the increase (this also applies where the tenancy is renewed).

- Fixed-term agreements:

- Agreements with a fixed-term of less than two years: Rent can only be increased if the agreement sets out the increased amount or how the increase will be calculated. The landlord does not need to give the tenant written notice of the increase.

- Agreements with a fixed-term of two years or more: Rent can only be increased once in a 12-month period. The landlord must give the tenant at least 60 days’ written notice of the increase.

- No written agreement: Rent cannot be increased during the first six months.

More info:

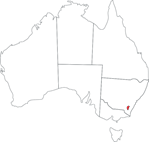

Australian Capital Territory

Australian Capital Territory

Overview:

- Periodic tenancies: Rent cannot be increased at intervals of less than 12 months. Landlords must give tenants at least eight weeks’ written notice of a rent increase.

- Fixed-term tenancies: Rent cannot be increased unless the amount of the increase, or a method of calculating it, is set out in the agreement. Once a fixed-term of at least 12 months has expired, the landlord can increase the rent after giving the tenant eight weeks’ notice.

- Prescribed amount: Rent increases are generally limited to the ‘prescribed amount’ (landlords can only increase the rent by 10 per cent more than the increase in Canberra CPI).

More info:

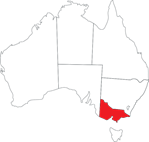

Victoria

Victoria

Overview:

- Periodic agreements: On 19 June 2019 the laws changed. Before that date, rent increases could occur once every six months. Since that date rent increases can only occur once every 12 months. Rental providers must give renters 60 days’ notice of a rent increase and provide information about how they have calculated the rent increase.

- Fixed-term agreements: The rental provider cannot increase the rent during a fixed-term agreement unless it is provided for in the tenancy agreement. If it is provided for, the agreement must state how the increase will be calculated. The rental provider must give the renter at least 60 days’ written notice of the increase.

- Agreements (leases) shorter than five years: Rental providers can only increase the rent if it is provided for in the rental agreement, otherwise the rent can only be increased at the end of the agreement. If an increase is permitted, the frequency is limited to once every six months for agreements started before 19 June 2019, or once every 12 months for agreements started on or after 19 June 2019.

- Agreements (leases) longer than five years: The rent cannot be increased more than once every 12 months, and only if the agreement states that the rent can be increased.

More info:

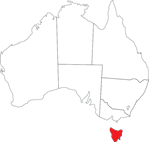

Tasmania

Tasmania

Overview:

- Rent can only be increased if there is a written lease that allows for rent increases, or if the lease is not in writing.

- Landlords must give tenants at least 60 days’ written notice of a rent increase and the notice must state the new amount and the date it applies from.

- In most cases, rent cannot be increased mid-tenancy, and can only be increased at the beginning of the lease, or at lease renewal or extension.

- If the lease is longer than 12 months, rent can be increased 12 months after the start of the lease.

- If the lease is less than 12 months, rent can only be increased at least 12 months after the tenancy started, even if the lease is extended or renewed.

More info:

Rent increase disputes

The ACT is the only jurisdiction that currently limits the amount by which rents can be increased. In other jurisdictions, landlords are likely to base rent increases on the prevailing rental market conditions and economic outlook.

If the tenant thinks the rent increase is excessive, they have the right to negotiate with their landlord/property manager and, if negotiation fails, the tenant can apply to the relevant tribunal or court to determine if the rent increase is fair and equitable. Matters to be considered include:

- whether the rent remains comparable with other properties in the area

- range of market rents usually charged for similar premises

- difference between the proposed and current rent

- term of the tenancy

- period since last rent increase (if any)

- the estimated value of the premises

- the cost of upkeep of the property paid by the landlord

- the cost of services provided by the landlord (or tenant)

- the value of the contents provided by the landlord for the tenant’s use

- the state of repair and general condition of the property

- any other considerations (e.g. if the landlord is putting up the rent simply to force the tenant out).

A rental increase is a matter on which landlords and tenants may not see eye-to-eye. If you are looking at increasing the rent, be sure to act within the rules set out in the legislation. No-one wants to end up at the tribunal or in court for doing the wrong thing – and you also don’t want to risk your landlord insurance cover.

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

Here are some great reasons why reading your PDS could be the most valuable few minutes you spend this year...

While the current rental market may appear favourable for landlords, it also brings a shifting set of expectations, risks, and responsibilities…

Prevention is far better than cure and, when it comes to avoiding tenant-related heartache, good communication can be the key...