A landlord insurance policy may offer cover for ‘denial of access’, but what does this actually mean?

Denial of access refers to a situation where a tenant stops paying rent and fails to vacate the property after being issued with a legal termination or eviction notice. In other words – they are not paying, and they are not leaving.

Without vacant possession of the property, it cannot be re-let, leaving the landlord without rental income. Some insurers call this no vacant possession, tenant default – court ordered termination, or failure to give vacant possession, but the meaning is essentially the same.

When this happens and a loss of rent claim is needed, it is important to remember that not all claims fall under the same umbrella. While denial of access is one category, others, such as rent default, have their own cover limits and conditions. Below, we outline what each category means and how they differ.

Cover for rent default

When a tenant defaults on rent, the landlord or property manager may need to issue a breach notice for non-payment, in accordance with the rules and regulations of their state. This notice gives the tenant a specified number of days to remedy the breach (for example, by repaying the outstanding rent or reaching an agreement with the landlord).

If the tenant fails to remedy the breach, a termination notice is then issued. This requires the tenant to either repay the rent owed or vacate the premises within the timeframe set out in their state or territory legislation.

If a tenant vacates the property without repaying rent owed, the landlord may be able to make an insurance claim. At EBM RentCover, we provide up to six weeks’ cover for loss of rent in this type of default situation.

However, if the tenant is issued with a termination notice and still does not comply, the landlord or property manager will need to pursue possession of the rental property. This is where denial of access can come into play, following non-compliance with a termination notice.

Cover for denial of access

When tenants refuse to pay rent and refuse to leave, the legal eviction process needs to be followed so possession of the property can be regained. The process should be commenced as soon as default happens (based on the applicable timeframes for issuing termination notices) to limit losses.

It is essential that landlords and property managers follow the lease termination, notice to vacate, or eviction process as outlined in their state or territory’s residential tenancies legislation. Although the specifics vary in each jurisdiction, key considerations should include:

-

Valid reason for eviction: Most jurisdictions now require a valid reason to evict tenants; ‘no grounds’ evictions have been removed or restricted. Rent default is typically accepted as a valid reason.

-

Follow the correct procedure: Eviction processes vary by state and lease type, including notice periods and forms. Strictly adhering to these rules is crucial. Incorrect procedures can lead to dismissal of eviction applications, delays in regaining possession, and potential impact on loss of rent claims.

-

Proper escalation: The eviction process must be followed step-by-step, often involving tribunal or court orders if tenants do not comply. This ensures compliance with insurance conditions to minimise loss and act lawfully, which is important for successful claims.

The reality is that the legal eviction process can be lengthy – from the initial default period before a breach and/or termination notice can be issued, to the tenant’s time allowed to repay or vacate, and through each stage of escalation. By the time vacant possession is regained, landlords may have lost many weeks of rent.

It is that loss of rent that has accumulated during the legal eviction process that a landlord may be able to recover through the denial of access provision in their policy.

Not all landlord insurance providers include cover for denial of access, and when they do, the level of cover can vary. At EBM RentCover, we offer up to 52 weeks’ cover for loss of rent due to denial of access. This cover applies from the day after the lawful eviction, termination, or possession order expires, and continues until the tenant vacates the property (either voluntarily or through tribunal/court proceedings). If there is still a fixed lease period remaining after the tenant vacates, the landlord may be entitled to up to a further six weeks’ cover, until the lease ends or the property is re-tenanted (whichever occurs first).

Summary

Denial of access is a type of loss of rent cover included in some landlord insurance policies. It applies when a tenant fails to comply with a termination notice, whether for rent arrears or another breach of the lease. This cover protects the landlord for the period between the notice’s expiry date and when vacant possession is actually returned.

Evicting tenants can be complicated and understanding how landlord insurance fits in can be even more confusing. At EBM RentCover, our Expert Care team is here to help. Just reach out with any questions – 1800 661 662.

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

We unpack the key rules, responsibilities and common misconceptions surrounding rental bonds...

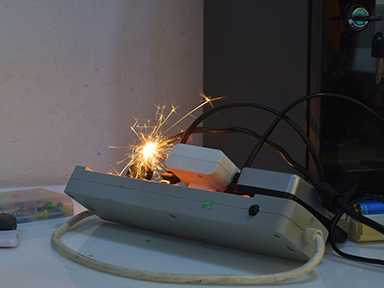

Do you know what to do if an electrical fault is found at your rental property?...

Damage caused by tenants and even owners doing DIY repairs or renovations is unlikely to be covered by the landlord’s insurance. We explain…