Does the type of lease agreement impact insurance cover? Yes, it can do! We explain…

But first, lets delve into the differences between the two main types of lease agreements - fixed-term and periodic.

Fixed-term tenancies

A fixed-term tenancy has a specific start and finish date. Once the fixed-term ends, you and your tenant can agree to a further fixed-term lease. If a further fixed-term isn’t set, the lease automatically becomes a periodic (month to month) agreement, which continues until either you or your tenant gives notice.

Periodic tenancies

A periodic (month-to-month) agreement is one where the fixed-term has expired. A periodic tenancy has no pre-determined finish date. It continues with the same terms and conditions under the original lease agreement, until either you or your tenant gives the appropriate notice to end it.

Insurance implications

Many landlord insurance policies require a fixed-term lease to be in place at the time of a loss, so make sure you understand your coverage regarding periodic leases and lease continuations. At EBM RentCover we do cover periodic leases, but how the policy responds may be different. This is because most policies will only respond to what has been lost in accordance with the policy limits. So, in the event of loss of rent, the tenant must be legally liable for any rent that is being claimed.

Speaking of loss of rent claims... this is the policy area where the tenancy agreement has the most impact when it comes to making a claim. For example, a policy may offer up to six weeks’ cover for rent default if a fixed-term agreement is in place but limit the cover to the notice period (such as two weeks) if a periodic agreement exists. NOTE: The notice period varies from state to state.

To put it another way, if a tenant is on a periodic lease, most policies will only pay the actual rent loss and not the rent you could have charged for any further period.

Let’s dig deeper…

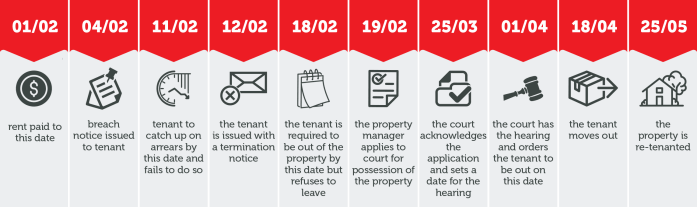

Say a tenant pays $700 a week on rent and has fallen two weeks behind in payments. The property manager does the right thing and issues a breach notice in a timely fashion, outlining that the tenant must rectify the arrears by a certain date. The tenant fails to catch up on rental payments, so the property manager issues the tenant with a termination notice, asking that the tenant moves out of the property by a nominated date. Unfortunately, the tenant refuses to budge, and remains in the property while still not paying rent. The property manager continues to follow the correct procedures (as outlined in their state legislation) and applies to court for possession of the property. The court sets a hearing, then orders a termination of the lease and orders the tenants to vacate the property on a certain date. The tenant vacates the property, and it is re-tenanted a month later.

Using the circumstances noted above, if the tenant was on a fixed-term lease, this is how a RentCover Ultra or Platinum policy might respond…

- Rental default would likely be covered from 02/02 to 18/02 (17 days) = $1,700

- Denial of access would likely be covered from 19/02 to 18/04 (59 days) = $5,900

- Loss of rent during re-tenancy would likely be covered from 19/04 to 24/05 (36 days) = $3,600

The total loss of rent payable = $11,200.

Meanwhile, if the tenant was on a periodic lease, this is how a RentCover Ultra or Platinum policy might respond…

- Rental default would likely be covered from 02/02 to 18/02 (17 days) = $1,700

- Denial of access would likely be covered from 19/02 to 18/04 (59 days) = $5,900

- Loss of rent during re-tenancy would not be covered.

The total loss of rent payable = $7,600.

Please note, the above is just an example, and all claims are evaluated on a case-by-case basis.

What do these scenarios indicate?

Due to the rules around periodic agreements, such as notice periods, the landlord insurance policy usually has corresponding limitations. For example, in respect to periodic tenancies, EBM RentCover Ultra and Platinum policies will only pay the actual rent loss and not the rent you could have charged for any further period where there is no ongoing liability for payment of rent by the tenant or ex-tenant.

The bottom line

It always pays to read the PDS and to ask your landlord insurance provider to clarify if you are unsure about cover. Do you have questions about your EBM RentCover policy? Chat to a member of our Expert Care team – 1800 661 662.

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

A lot has changed in the short-term accommodation market over the past decade. This is what you need to know...

Ever wondered just how many claims are made on landlord insurance policies each year? Wonder no more!...