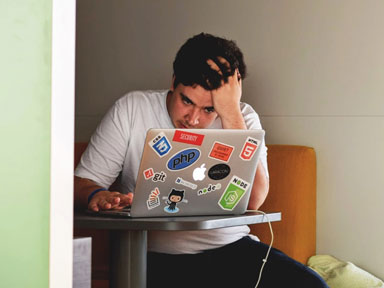

When money is tight, eventually something might have to give. And for tenants, that something may just be the rent payment.

Every year, EBM RentCover receives thousands of claims for loss of rent. While there are numerous reasons why a landlord may suffer loss of rent, a leading reason is rent default – where a tenant has fallen behind on their rent payments and not been able to catch up within a reasonable timeframe, resulting in the lease being terminated with rent outstanding.

Given how frequently landlords need to claim on their insurance for rent default, it is wise to ensure that an insurance policy includes this cover. With the right insurance, landlords may be able to recoup some of the losses they have suffered due to their tenant defaulting on their rent.

It is good to know that landlord insurance offers a financial safety net in the event that a tenant defaults on their rent but, as is always the case – prevention is better than a cure.

Even the best prepared landlord can be caught out by circumstance, but there are a few things they can do to help reduce the risk of rent arrears in general.

Before the tenant is in the property

-

Engage a property manager. While certainly not their only task, rent collection is a key responsibility for property managers. A good agent will have effective and efficient procedures and systems in place to manage the process and to deal with any issues if they arise.

-

Set a reasonable rent. Given it is a ‘landlord’s market’ – with limited availability, high demand and rising rents – it may be tempting to peg the rent at the higher end of the rung. However, an overexaggerated rent could result in the tenant struggling and not being able to pay.

-

Carefully screen tenants. Ensure all the usual checks have been carried out – employment, reference, income, and tenancy databases. In the current economic climate, particular attention should be paid to the tenants’ financial situation and whether they can afford the asking rent (and the bond, which must be collected as a condition of landlord insurance cover). The total household income should be enough to cover the rent plus normal living expenses. If the prospective tenant would be paying more than 30 per cent of their income in rent, they may not be able to afford it or may be putting themselves at risk, should a financial emergency arise.

-

Be clear on rent payments. The rent payment procedure should be properly documented. To help avoid the risk of non-payment, the most suitable day/date for the rent to be paid (e.g. to coincide with when the tenant is paid) should be determined and a direct debit set up to automate payment. Any instalment options that might make it easier for tenants to budget, and ensure payments are due at regular shorter intervals rather than monthly or quarterly, could also be explored.

After the tenant is in the property

-

Monitor rent payments. Check for payment on the day the rent is due and, if the payment has not been made within the legislated timeframe, take action. As a missed payment may just be an oversight by the tenant, the property manager or landlord should get in touch and have a chat. If the missed payment exceeds the overdue timeframe in the relevant state or territory, it is important to issue breach notices promptly, regardless of whether it is a one-off occurrence.

-

Conduct regular inspections. Conduct regular property inspections and watch for warning signs the tenant might be about to do a ‘midnight flit’ and leave owing rent – things like the tenant avoiding calls to set up an inspection, the cupboards being bare, bill reminders on the benchtops, dwindling possessions like clothing and furniture, packing boxes onsite, or disconnected services.

-

Maintain a positive relationship. Open and transparent communication with tenants can often mean that they let you know early if they are experiencing payment difficulties. Knowing there is a problem gives you the opportunity to put a plan in place to tackle the arrears before they spiral out of control.

Know what to do if things don’t work out

If a tenant is in arrears and cannot or will not catch up on what is owed, the landlord or property manager will need to understand and follow the proper legal procedures for payment or eviction.

Of course, rent arrears is a situation neither tenant or landlord wants to be in. No landlord or property manager would knowingly lease a property to a tenant they thought would default on their rent, and no honest tenant would take on a tenancy knowing they couldn’t pay.

Unfortunately, no-one can foresee whether an event might impact a tenant’s ability to pay rent (like the tenant falling ill, losing their job, having a relationship breakdown, their partner passing away, or incurring an unexpected large expense). But landlords and property managers may be able to help reduce the risk of rent default by following the tips above – and protect their incomes by having specialist landlord insurance with cover for rent default in case they get tripped up despite their best efforts.

It isn’t an easy situation to find yourself in – when a tenant stops paying rent. If you have questions about loss of rent cover in any EBM RentCover landlord insurance policies, reach out to a member of our Expert Care team – 1800 661 662.

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

When a tenant signs a rental agreement, they are ultimately agreeing to the ‘house rules’... But, what happens when they break the rules?...

To avoid arguments, it helps to know who is responsible when it comes to tasks around the rental property...

Did you know a tenant's ‘rental stress’ is shared with landlords. Read on to find out why...