Thinking of cancelling your landlord insurance policy? Read this first.

There’s no denying that the cost of living is on the rise – groceries, petrol, utilities. The cost of managing your rental may also be increasing – interest rates rising, escalating prices for goods and services impacting routine maintenance and repairs, higher council rates and possibly even property manager fees going up.

If you’re finding more money is going out and you can’t recoup the extra costs by upping the rent you charge, you might look for ways to save money.

But if you’re thinking of cutting out insurance cover for your investment property, you might want to think again. It could prove a costly false economy. And we explain why below…

“It’s unnecessary”

Insurance can seem like an unnecessary expense when you don’t need to make a claim. You might luck out and never have something go pear-shaped at your rental. Then again, you might not. Last year, EBM RentCover settled more than 6,400 claims with a value of more than $39 million. That’s a lot of landlords who weren’t so lucky.

All insurance – whether it’s for your investment property, your own home, your health, your life, your fur-baby, your income or your car – is about risk. The thing is – life is risky. No-one knows what’s going to happen and what impact it could have. You take out insurance so that you are financially covered should the worse happen. It’s about peace of mind and protecting what’s important to you.

“It’ll never happen”

Every day we talk to landlords who never thought they’d need to make a claim on their insurance. No-one expects their tenant to default on their rent, that Mother Nature will unleash her wrath, the property will be burgled, there’ll be an accident, or someone will get injured on the premises. But, these things can – and do, more often than you might imagine – happen.

Regardless of how well a property is maintained, how expertly it’s managed or how reliable the tenants are, sometimes things just happen.

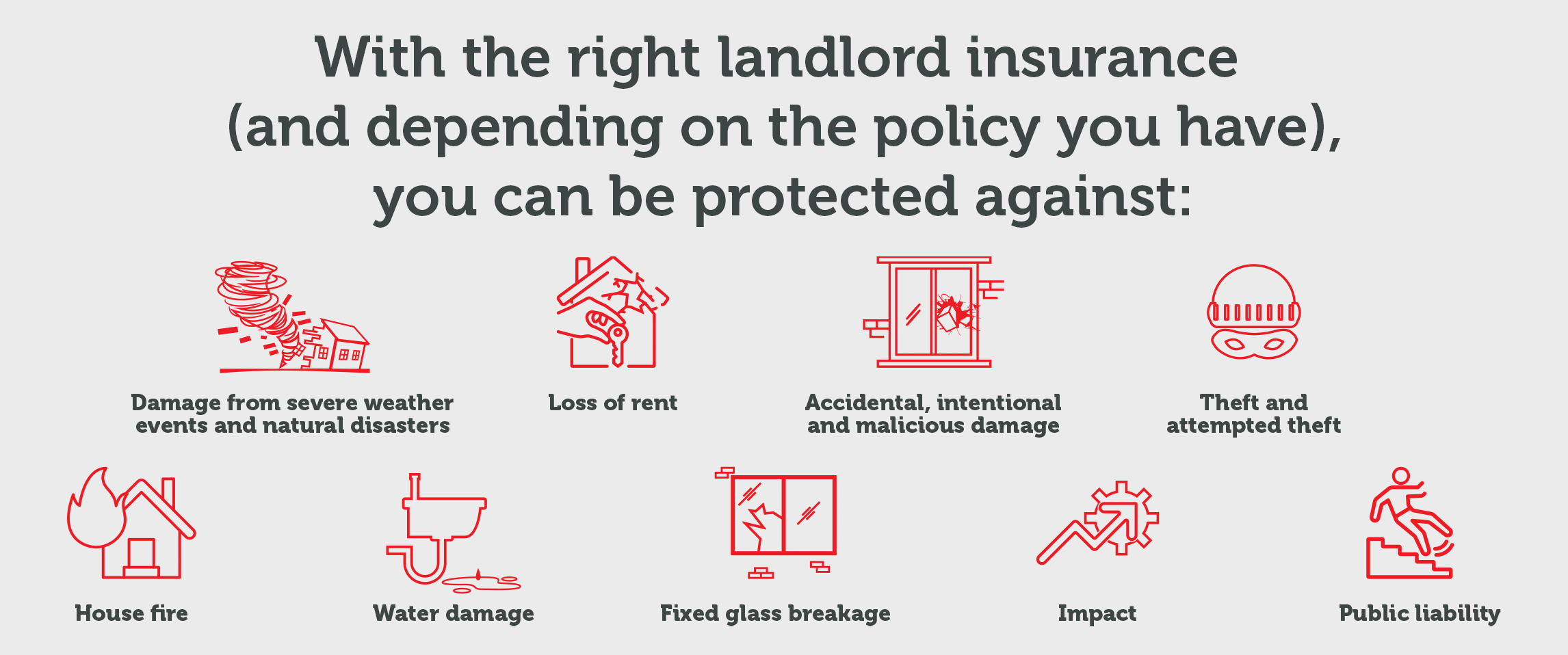

Every year, thousands of claims are lodged for damage caused by insured events like natural disasters (bushfires, floods, storms, cyclones), water damage, glass breakage, theft or impact. Some repairs may cost a few hundred dollars, others can cost hundreds of thousands. While you may be able to foot a small repair bill, you should consider whether you can afford to replace your property if it were severely damaged or destroyed.

Depending on your landlord insurance policy, your building and contents may be covered, allowing your investment property to be re-revived and return to providing an income for you.

“My tenants are sound… and so is my property manager”

More than half of the claims we settle each year are for tenant-related issues like loss of rent or tenant damage. You can have the best property manager and the best tenants, but life can conspire to derail the best intentions. Tenants can find themselves unable to pay their rent due to circumstances beyond their control – job loss, relationship breakdown, illness, partner death, financial hardship. And, if they can’t catch up on the arrears, landlords can be left seriously out-of-pocket. If there’s major accidental damage (e.g. fire) at the property caused by your tenants, their children, their pets or their guests, it may also be impossible for them to pay for the repairs. With specialist landlord insurance, tenant-related losses can be covered. Without a policy, you’re on your own – financially, at least.

“The bond will cover it”

If you’re thinking you don’t need landlord insurance because you’ve got the bond money to cover rent arrears or damage, think again. A bond only covers four weeks’ rent and if there’s major damage to the property and/or unpaid rent, that bond is going to be drained and you’re going to be left to foot the bill (and possibly chasing your tenants through the courts – a costly proposition). NOTE: At EBM RentCover, the average amount we paid out in a single claim in 2022 was $7395.06 – this dollar amount is typically more than four-weeks rent in most properties.

“Insurance isn’t worth it”

The value of insurance is subjective; it’s personal to you. You may be happy to risk not having insurance, or you may value the safety and comfort of knowing you’re covered financially if things go wrong at your rental.

Without landlord insurance, you may find yourself paying for damage, losing income from non-payment of rent, losing your investment property (if you can’t afford to repair/replace it) or even jeopardising your financial future if you are sued for negligence (public liability claims can stretch into the hundreds of thousands and millions of dollars).

If you’re thinking of cancelling your landlord insurance policy, we urge you to think again. Ultimately, you should ask yourself if you can afford not to have insurance...

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

Here are some great reasons why reading your PDS could be the most valuable few minutes you spend this year...

While the current rental market may appear favourable for landlords, it also brings a shifting set of expectations, risks, and responsibilities…

Prevention is far better than cure and, when it comes to avoiding tenant-related heartache, good communication can be the key...

.png;.aspx?width=1200&height=675&ext=.png)