Water damage is a common landlord insurance claim – but not all damage is covered.

Rental properties can be damaged by water in many ways: leaks, bursts or overflows from appliances (fridge, dishwasher, washing machine), plumbing fixtures (drains, pipes, baths, sinks, toilets), or from external events like floods and storms.

EBM RentCover, like most insurers, covers two key types of water damage: storm damage and escape of liquid. We guide you through the key details, so you are not caught out when the worst happens.

Insured event – storm damage

EBM RentCover policies include storm and flood cover under natural disaster protection. Storm damage is automatically included in all our landlord insurance policies. Flood cover is also automatic for most properties, except those in high-risk flood zones.

Storm damage includes water caused by:

-

Rain (including snow, sleet or hail)

-

Flooding from heavy rainfall

-

Cyclones or hurricanes

Important: Damage from the sea (tidal waves, high tide, king tide, storm surge) is not covered, except for tsunamis.

Coverage limits: Up to $70,000 for contents and up to the building’s sum insured under natural disaster cover.

Insured event – escape of liquid

Extreme weather is not the only threat – escaping liquid can cause just as much damage. Escaping liquid occurs when a liquid (usually water) accidentally leaks or spills from its intended location, causing damage.

EBM RentCover protects against damage caused by:

-

Bursting or leaking pipes

-

Overflowing or discharging basins or baths (fixed in place)

-

Bursting, leaking, or overflowing appliances provided by the landlord

-

Leaking tanks or roofs

-

Sewerage discharges

-

Sudden escape from waterbeds or aquariums

Important: Cover applies to damage caused by the liquid, not the repair or replacement of the pipe, appliance, or tank itself.

Coverage limits: Up to $70,000 for contents and up to the building’s sum insured under natural disaster cover.

Water damage caused by tenant actions (e.g. overflowing appliances) is generally the tenant’s responsibility. If the tenant fails to repair the damage, landlords may be able to claim under accidental damage, depending on the policy.

What is not covered?

Some landlords think that any water damage at their rental property will be covered, but the reality is not the case. At EBM RentCover we believe in being open and honest, and there are times when water damage will not be covered. These include:

-

Gradual water damage – gradual water leakage or damage caused by rust, corrosion, or general wear and tear may not be covered. Loss or damage which occurs gradually over time is generally excluded as it an issue that the policyholder could have reasonably been aware of and there is a condition of cover that requires the policyholder to act to prevent future damage and loss.

-

Mould, mildew, algae and fungus – cover for mould is generally excluded as its growth can often be prevented. Cover may be provided if the mould is a result of an insured event and not something that has developed over time.

-

Lack of maintenance – there is a condition in policies that requires the premises to be adequately maintained. If a lack of upkeep contributed or caused the water damage, then any claim is likely to be impacted. This includes things like the porous condition of any tiles, grouting or sealant. It is also important to know that normal wear and tear is not covered by insurance.

-

During works – there is no cover for damage caused by water entering the premises through an opening made for the purpose of alterations, additions, renovations or repair.

It is important to understand, when it comes to making a successful claim for water damage, cover only applies when an escape of liquid is sudden or accidental, or the result of a natural disaster such as a storm.

If you have any questions about cover for water damage in EBM RentCover landlord insurance policies, please contact our Expert Care team.

*While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you need us we are here, contact 1800 661 662 if you have any questions.

You may also like

View all

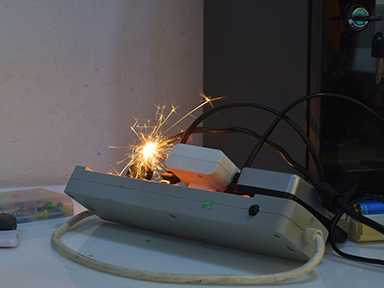

Do you know what to do if an electrical fault is found at your rental property?...

With a little proactive maintenance, you can significantly lower the risk of nature taking its toll during winter...

If you get a call from your tenants complaining that they can smell gas at the rental, then you’re going to need to know what to do…